Social media listening is a powerful tool for banks to build a connection with their customers. The financial industry is not fully involved in social media planning and strategizing yet, but with the right information about their audience, banks can tap into all the benefits and rewards social media can offer. It can be used to increase the opportunity to build touchpoints so consumers can find it easier to deal with banks.

Banks belong to an industry that will always exist in this world. People will always need to handle their finances. However, it does not mean banks are protected. Customers make the choice of choosing a certain bank over another based on the level of customer satisfaction and loyalty. So it is necessary for banks to understand how consumers feel about their services, and how they prefer to interact with them by monitoring consumer behavior.

Using the Crowd Analyzer tool, we looked into 76 social accounts of the top banks in the GCC region during the first two weeks of October to identify the latest consumer trends. In this article, we provide actionable insights relevant to the GCC market that can be used to establish a stronger social media presence and gain valuable insights for consumer interaction.

1. Understand the social media landscape based on location

For social media to be effective, it is key to listen to the audience to get a full grasp of the source of conversations. It is important to understand what is considered popular in the banking industry depending where your target audience is. Based on the monitored period, there were a total of 535K social media activity with 19% engagement rate. It is essential for banks to understand their position in the market in relation to competitors by taking a look at the most popular banks in each country.

Every country will have a different level of activity when it comes to social media. So it is important to monitor the level of interaction based on the frequency of posting. If a bank is posting, but not getting enough responses from the public; this likely means that the content is irrelevant. Social media is an opportunity to build relationships with your customers by creating content that initiates conversations and encourages interaction. In the GCC region, Kuwait had the highest level of engagement at 87%. It was followed by Bahrain at 78% and Oman at 71%. The least activity of engagement came from KSA. This indicates that when it comes to banking, users do not interact with banks on social media.

2. Create content that is relevant to your audience

There are various social media channels that can be used to build a strong presence and establish a relationship with the audience. However, it is important to listen to where your target audience exists on social media. By focusing on the right platforms, you will be able to establish a relationship with your audience. Each platform has its own way of communication whether it is by visuals such as Instagram or text such as Twitter. Based on the data, users interacted with posts that involved photos at 79%, followed by text and videos. Hence, it was no surprise that Instagram took the lead by 79%. In banking, content should be more visual than text. Facebook was the least platform to gain interaction at 10%.

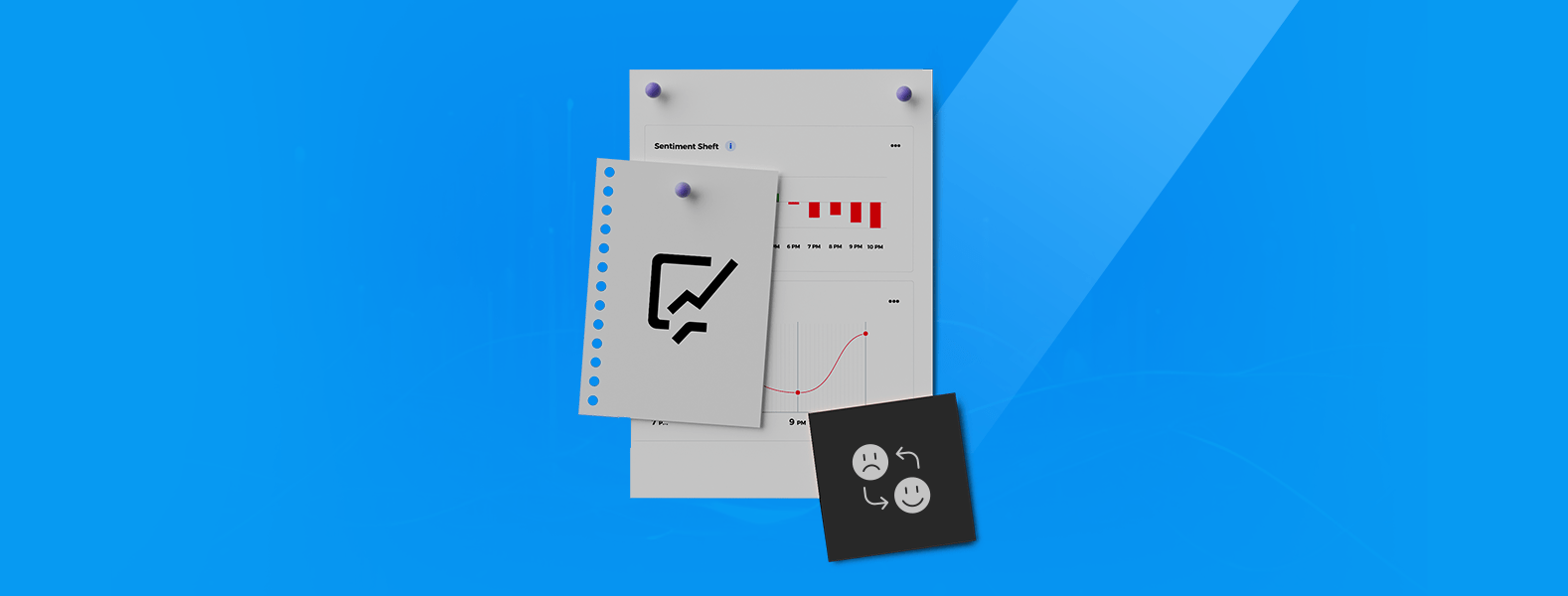

3. Communicate with your audience to avoid a potential crisis

Social media gives customers the power to voice out their opinions and enables banks to reach out to customers. The future of banking is digital and social media will play a major role in shaping it. It opens a world of possibilities in personalizing customer experience and avoid a potential crisis, before its too late. Banks in the GCC region are already focusing on using social media for customer support; there is so much potential in the ways social media platforms can be used to enhance the customer journey. Based on the data, it is shown that the majority of banking conversations are related to customer service at 58%, then services such as loans and deposits at 16%. This indicates that the way banking and financial services works is expected to shift towards the digital sphere.

Social media is the first place dissatisfied customers will go with their thoughts and feelings about a business. If there is a spike of mentions of your bank, it is always worth looking into to make sure that it is not negative tags or comments. A key advantage of social listening is access to data in real time which is an opportunity to do some reputation management and customer service. Being responsive to customers right away helps build a relationship of trust, which leads to loyal customers that will stick to your bank.

Using the Crowd Analyzer tool, we managed to help banks in the GCC region get a better understanding of consumer behavior based on their target audience. Based on this information, you can fuel your social media strategy in the right direction creating a better experience for your customers and connecting with them through relevant content. If you want to know more about what we can offer to help you compete more effectively to create a strong presence on social media, get in touch with us now.