Have you ever wondered how it would look if music streaming wasn’t invented? The variety of streaming services make it easy for the music lovers to enjoy the music anytime and anywhere without the need to buy the CDs and load songs into the devices manually. Now music lovers can play and share their favorite music from all over the world without the need to buy every single or album.

Streaming services have a massive impact on the whole music industry, it formed 75% of the revenue of the industry. Before the streaming services, CDs sales weren’t profitable since piracy and illegal online sharing was the cheapest and easiest way for consumers to get access to music via the internet.

The MENA region has plenty of music lovers, artists, and major record labels. There is a big interest in using streaming services like Anghami; the first music streaming service in the Middle East since 2012. But the play alone role has ended since Spotify and Deezer came to the MENA market and the competition started on the social media conversations before the launch of each.

Sharing Shows Caring

During the last quarter of 2018 (Oct 2018 – Dec 2018) of monitoring, we analyzed a sample of online users mentions about Anghami (305.5K mentions made by 84.63K engaged users) in both Arabic and English with different variations. out of the analyzed mentions, #Nowplaying mentions got 46% of the mentions made by 27K unique users and gained around 93.25K engagement.

This empowers the insight that sharing music from Anghami on social media will get the audience interest in using the app to play and share their favorite music.

A good recommendation hint for any streaming service is to encourage the audience to share the music on their social accounts (e.g. share more to win free premium trial experience) will help to increase the reach and stand rival in front of competitors.

Measuring the Rivalry

Analyzing a representative sample of mentions about Anghami and other music streaming competitors; Deezer and Spotify we found that around 13% of these mentions were interested in the rivalry between these apps. tweets about the rivalry got higher engagements during Nov 2018 in alignment with the launch of Spotify in the Middle East.

A lot of users stated that the competition was in their favor as each service will present their best features and offers.

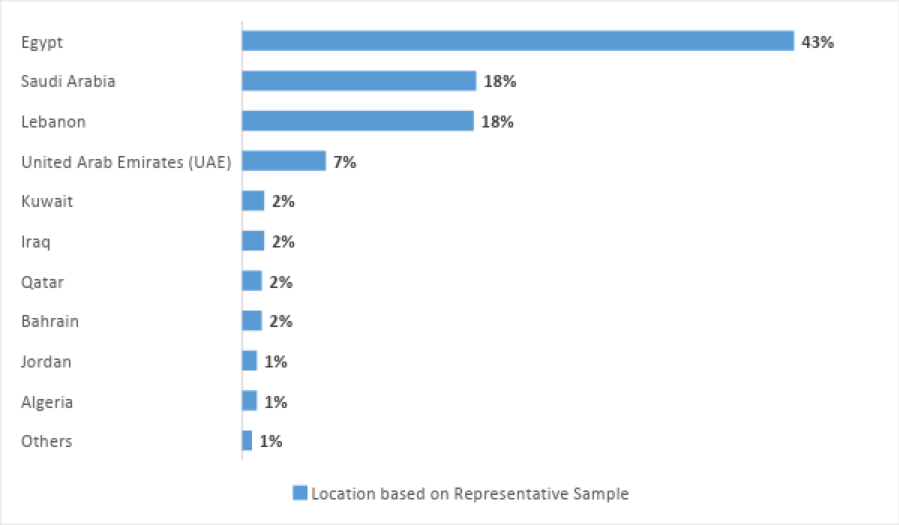

Digging deeper into this sample we analyzed the users’ demographics and figured out what users have liked and disliked about each music service.

Measuring the positive reviews for each app through Twitter mentions, we found that Anghami had many loyal users who preferred using it no other services. The majority (40%) of loyal users were from Lebanon who was encouraging the use of their national service.

Anghami Pros

- We found that 31% of Anghami positive mentions reviewed that users favored Anghami for the friendly user experience that allowed them to navigate the music player easily.

- Also, extensive Arab song library was a major key for Anghami users’ favor.

Anghami Cons

- 61% of online mentions about Anghami, were users interested in turning over to another competitor especially to Spotify as 48% of the turnovers didn’t feel comfortable with the breaking ads on songs that discomfort their music listening experience. Mostly the rest stated would love to turnover for just the interest to try the worldwide known music services Spotify and Deezer.

- The lack of non-English or non-Arabic songs and the underground genre has formed 20% of the negative reviews.

- The rest of the negative mentions were about the limited (96kpbs) sound quality in the free version,some users expressing that the subscription fees are overpriced, and others said “we just don’t like it”

Spotify Pros

- Spotify worldwide reputation made 53% of positive mentions, users showed an interest in the app even before the official launch.

- sound quality, extensive song library, and fewer ads made up 45% of positive reviews by users sharing their feedback after experiencing the app.

Spotify Cons

- 54% of negative mentions stated that the free version didn’t give them the satisfying user experience especially with the limited skips and choice of songs.

- 29% found that Spotify misses a lot of Arabic songs unlike Anghami, Apple Music, and Deezer.

- 17% found that the price of the premium subscription is high.

Deezer Pros

- 69% of positive mentions showed the interest in the user experience (the interface and navigation of the music with) beside the competitive high sound quality.

- During the launch of Deezer, the offer of getting free 6 months of premium subscription had the rest of positive buzz.

Deezer Cons

- Lack of some musical content was found on other platforms and the high price of subscription was the main reasons for negative concerns

In the end, we found that there is no one single choice for MENA users to stick to it. Music lovers preferred music apps based on different metrics and the single user could use many apps at the same time.